Depreciation expense formula

The DDB rate of depreciation is twice the straight-line method. Unit Depreciation Expense Fair Value Residual Value Useful Life in Units.

How To Calculate Depreciation Expense

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

. Depreciation Expense Beginning Book Value for Year 2 Useful Life. Asset cost - salvage valueestimated units over assets life x actual units made. Easily Track Your Business Expenses - Get Started With QuickBooks Today.

The group depreciation method is used for depreciating multiple-asset accounts using a similar depreciation method. Lets use a car for an example. The intent of this.

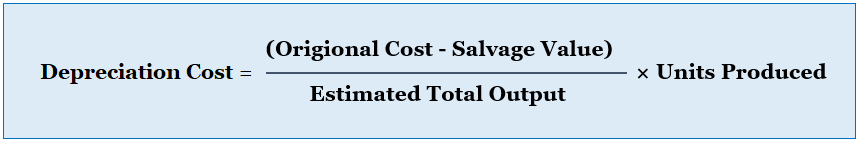

This amount is then charged to expense. Depreciation expense is that portion of a fixed asset that has been considered consumed in the current period. Periodic Depreciation Expense Unit Depreciation Expense Units Produced.

Annual Depreciation Expense 8000 1000 7 years. Depreciation represents the allocation of the one-time capital. The formula is as followed.

Depreciation expense Assets cost Assets scrap value Assets useful life. Useful life of the asset. Ad Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software.

Start with the cost of an asset and multiply by the number of units. Companies use the following straight-line depreciation formula. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

The purchase price of these hypothetical forklifts is 7000 apiece for a. You then find the year-one. 80000 5 years 16000 annual depreciation amount.

Depreciation Expense Total PP. What Is Accumulated Depreciation. Divide step 2 by step 3.

Section 179 deduction dollar limits. Therefore Company A would depreciate the machine at. In year one you multiply the cost or beginning book value by 50.

The straight-line depreciation method is the easiest to calculate and the annual depreciation amount original net value of assets-estimated residual value service life. Depreciation is an accounting method that spreads out the cost of an asset over its useful life. Straight line depreciation is the most commonly used and straightforward depreciation method for allocating the cost of a capital.

The formula for straight-line depreciation is. Annual Depreciation Expense Cost of the Asset Salvage Value Useful Life of the Asset. Depreciation expense is the cost of an asset that has been depreciated for a.

The assets must be similar in nature and have approximately the same. Example of a Depreciation Expense. Asset-based depreciation calculate your share of deprecating assets in a partnership calculate the decline in value on multiple assets compare depreciation amounts.

For example an asset with a useful life of five years would have a reciprocal value of 15 or 20. It has a useful. 25000 - 50050000 x 5000 2450.

This limit is reduced by the amount by which the cost of. DDB Net Book Value - Salvage Value x 2 Useful Life x Depreciation Rate. You buy a car for 50000.

Double Declining Balance Method Of Depreciation Accounting Corner

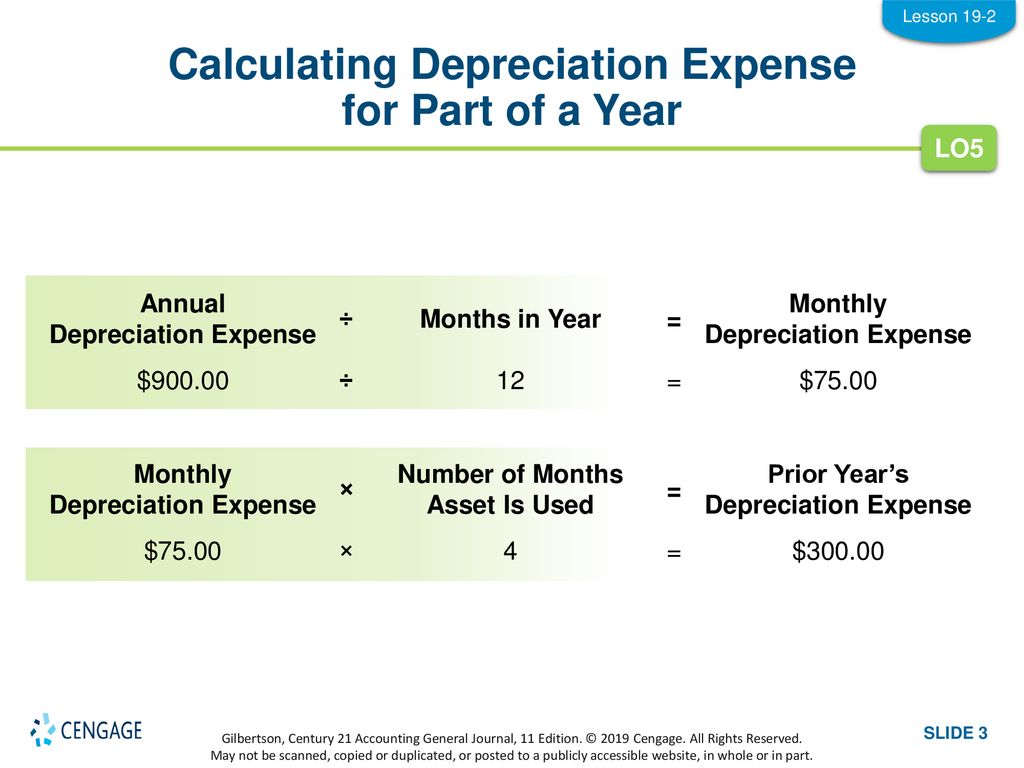

Lesson 19 2 Calculating Depreciation Expense Ppt Download

Double Declining Balance Method Of Depreciation Accounting Corner

/GettyImages-1174783581-020e7504020947dc979f864f2ebee096.jpg)

Accumulated Depreciation And Depreciation Expense

Accumulated Depreciation Definition Formula Calculation

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

Depreciation Methods Principlesofaccounting Com

How To Calculate Depreciation Expense Otosection

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Unit Of Production Depreciation Method Formula Examples

Declining Balance Depreciation Double Entry Bookkeeping

Straight Line Depreciation Formula And Calculation Excel Template

How To Calculate Depreciation

Double Declining Balance Depreciation Daily Business

How To Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense